Industry main listed companies: Open Medical (300633), Dabo Medical (002901), Mindray Medical (300760), Wanfu Biological (300482), Lepu Medical (300003), Feito (002528), Sanuo Biological (300298), Yuyue Medical (002223), Neussoft Medical (210288), Xinhua Medical (600587), etc

Core data: The number of high-end medical device enterprises; High-end medical equipment scale; High-end medical device core technology

Industry Overview: High-end medical device industry chain panorama and value chain distribution

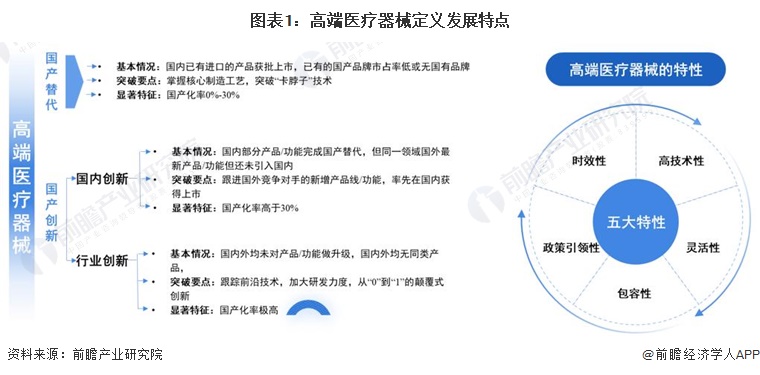

-- Definition and characteristics of high-end medical device industry

The definition of high-end medical devices is seen from two dimensions, one is from the domestic substitution dimension, and the other is from the domestic innovation dimension, which includes domestic innovation and industry innovation. The "high-end" of medical devices has a certain timeliness, with the rapid development of technology and the full penetration of domestic alternatives, the development path of high-end medical devices will continue to migrate and evolve, which has a certain flexibility and inclusiveness.

-- Overview of high-end medical device industry classification

At present, there is no unified classification of high-end medical devices, combined with the "Industrial structure Adjustment Guidance Directory (2023, draft for comments)", the high-end medical device planning of various provinces and cities, and the research data in the "Medical device Blue Book 2023", the high-end medical devices are mainly divided into the following categories. Including the core raw materials upstream of the industrial chain are also in urgent need of localization and innovation.

-- High-end medical device industry chain panorama: the industry chain is long and has many subdivisions

The high-end medical device industry chain specifically includes upstream raw materials and related components, all kinds of high-end medical devices in the middle stream, and downstream application scenarios. Among them, the upstream of high-end medical device industry chain is mainly biological materials, medical electronic components and so on. High-end medical devices include high-end medical imaging, life information monitoring and support, implant intervention equipment, surgical robots, artificial intelligence medical devices and so on. The downstream of the high-end medical device chain mainly includes various hospitals, medical laboratories and centers for Disease Control and prevention.

Industrial Policy: High-end medical device industry policy environment

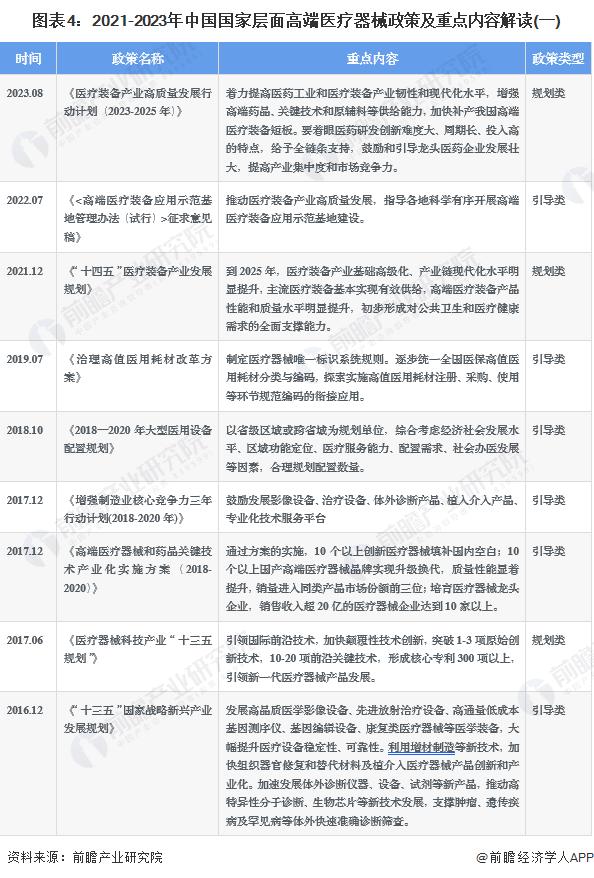

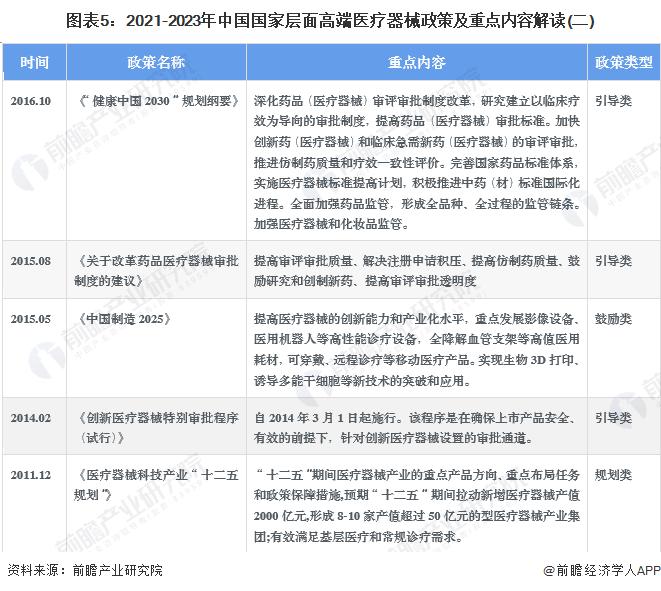

-- Summary of key policies for China's high-end medical devices

With the occurrence of accidents and disasters in our country, it is very urgent to develop the safety emergency industry. Energy conservation and environmental protection industry is one of the national strategic emerging industries, its development is related to the high-quality development of the national economy, but also "3060" carbon peak, carbon neutral goal to achieve an important field, is a huge market potential of the emerging industry. In recent years, the state has introduced a series of policies to promote the development of high-end medical devices, 2013-2022, the main policy planning at the national level of the industry is as follows:

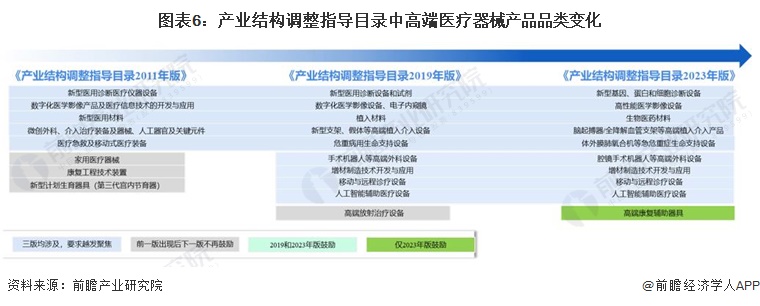

-- Changes in high-end medical devices in China's industrial structure adjustment catalog

Since 2016, the policy support has increased significantly. At the same time, in the third edition of the Guidance Catalogue for Industrial Structure Adjustment, the encouraged products of high-end medical devices have changed greatly, such as household medical devices, which were included in innovative medical encouragement products in 2011 and cancelled in 2019. The third edition of the guidance catalogue continues to encourage the development of medical diagnostic equipment, high-end medical imaging, implant interventional equipment.

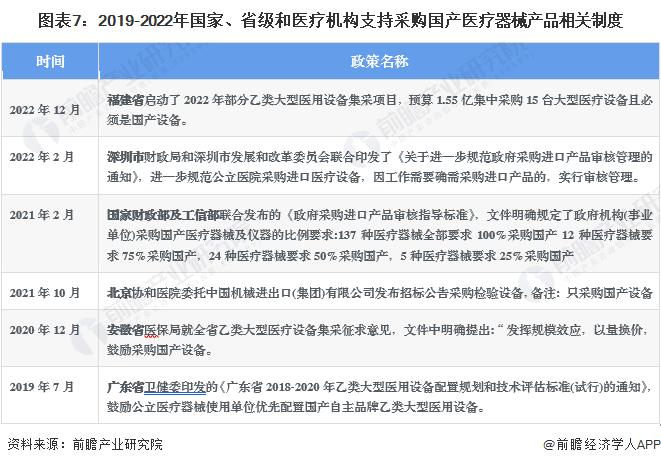

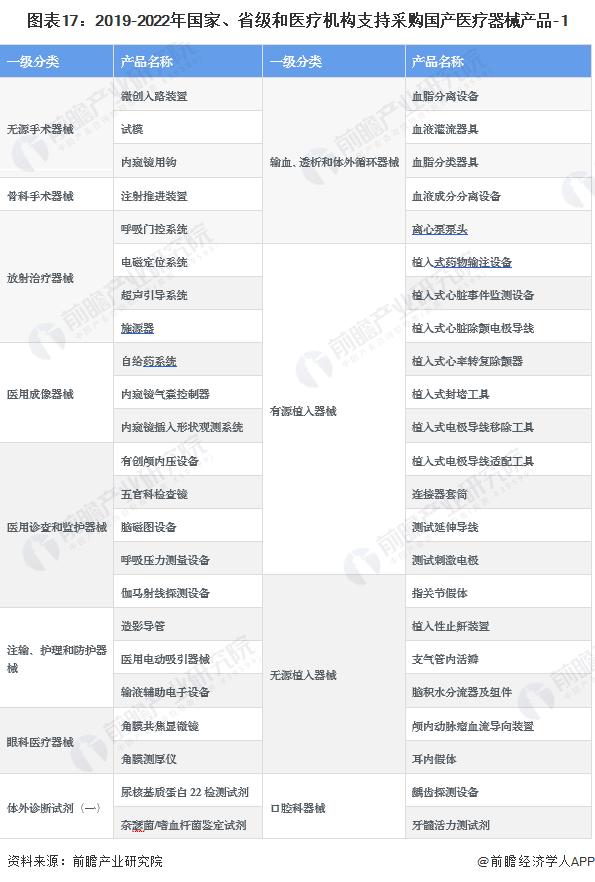

-- National, provincial and medical institutions support the procurement of domestic medical device products

In recent years, the state, provincial and medical institutions support the procurement of domestic medical device products, "limited domestic" is not an exception.

Industrial development: Policy to promote the expansion of industry scale

-- Development status of medical devices: the scale continues to grow

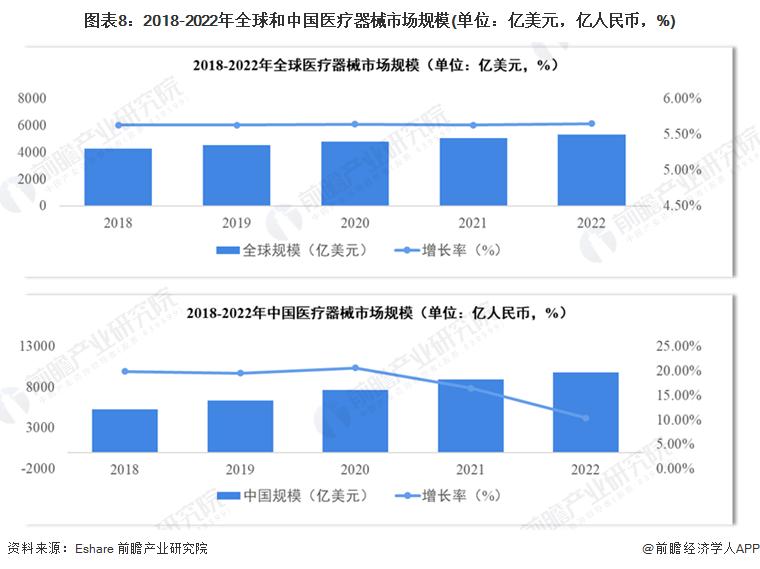

From 2018 to 2022, the global medical device market continued to rise, with an average annual growth rate of more than 5%, the global medical device scale reached 532.8 billion US dollars in 2022, and the market size in China reached 983 billion yuan in 2022, an increase of 10.35%.

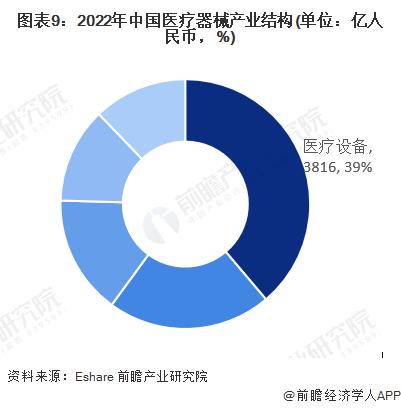

In the size of China's medical device market in 2022, the scale of medical equipment is 381.6 billion yuan, accounting for 39%, followed by household medical devices 208.6 billion yuan, accounting for 21%.

-- High-end medical device innovation approval: approval boom hits

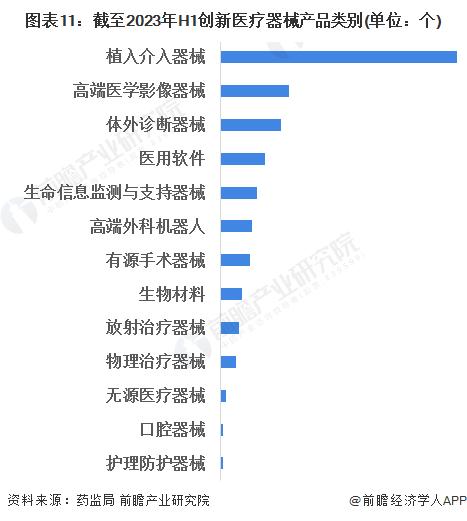

In March 2014, the state officially opened the rapid approval channel for innovative medical devices, the medical devices entering the channel need to be "domestic first products", basically in line with the definition of high-end medical devices, which can glimpse the status quo of high-end medical devices through the registration and approval of innovative medical devices. From 2014 to the first half of 2023, the State Food and Drug Administration approved a total of 217 innovative medical devices.

-- Analysis of the strategic position of high-end medical device market segments

From the perspective of the existing product categories that have passed the approval and listing of innovative medical devices, the number of implanted interventional devices is the largest, reaching 89, and the heart implant devices and neurostimulation devices are the main ones. Followed by high-end medical imaging equipment, subdivision is mainly angiography X-ray machine, endoscope and so on.

Enterprise layout

-- There are more Chinese enterprises in high-end medical devices

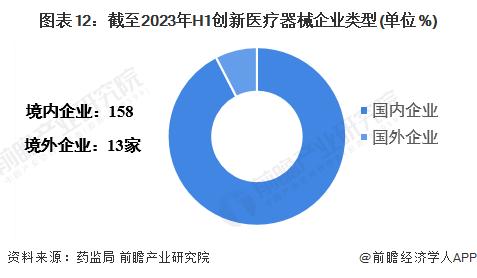

As of the first half of 2023, there are 171 domestic innovative medical device enterprises, of which 158 are Chinese enterprises and 13 are overseas enterprises.

-- Listed medical device enterprises: Mindray Medical revenue first

According to the announcements of the companies, among the listed companies of high-end medical devices, Mindray Medical's revenue scale ranks first, reaching 4.51 billion US dollars in 2022, followed by Jiuan Medical's 3.91 billion US dollars and Dean Medical's 1.79 billion US dollars.

Area layout

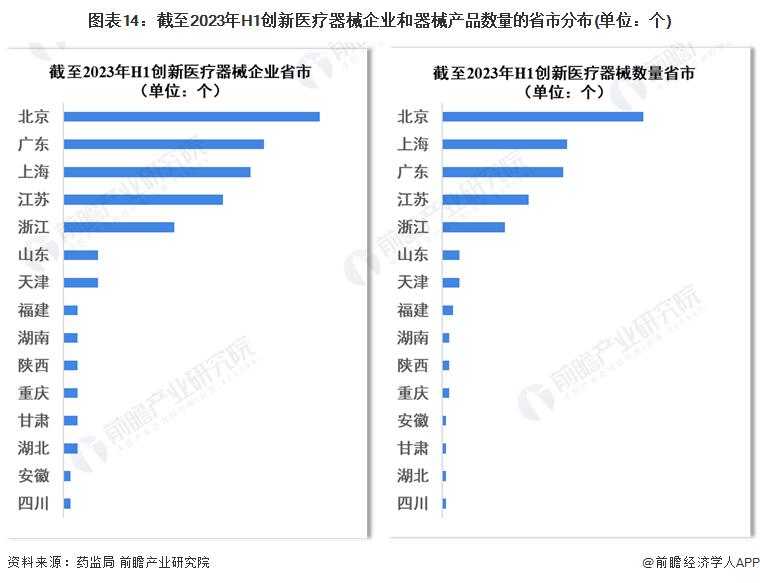

-- Regional distribution of China's high-end medical device innovation approval: Beijing, Guangdong and Shanghai are the hottest

In the existing 217 innovative medical device approval projects, Beijing, Shanghai, Guangdong, Jiangsu, Zhejiang innovative medical device approved products and the number of corresponding enterprises are the largest.

-- Distribution of China's high-end medical device industry clusters: located in Shenzhen, Guangzhou and Suzhou

According to the list of 45 national advanced manufacturing clusters announced by the Ministry of Industry and Information Technology, the current high-end medical device industrial clusters mainly include Shenzhen, Guangzhou high-end medical device cluster, Suzhou biomedicine and high-end medical device cluster.

Industrial technology

-- Medical devices urgently need to be localized products

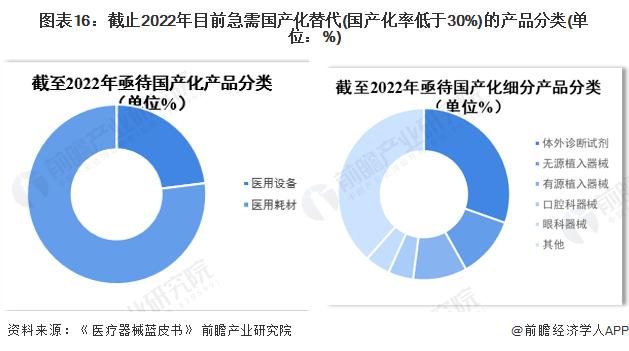

According to the new "Medical Device Classification Catalogue", medical devices are divided into 22 different types of subcatalogues, and in vitro diagnostic reagents are separately managed according to the "in Vitro Boost Reagent Classification Catalogue". From the point of view of the products in urgent need of localization replacement (localization rate is less than 30%), there are currently 148 products in urgent need of localization, of which 77% are consumables; Among the subdivided products, the localization rate of in vitro diagnostic reagent products is less than 30% for 45 products, followed by implant devices (active and passive), dental instruments and ophthalmic instruments.

By the end of 2022, there are 85 products in the field of medical devices in China with a zero localization rate, mainly distributed in vitro diagnostic reagents, active implanted devices and passive implanted devices.

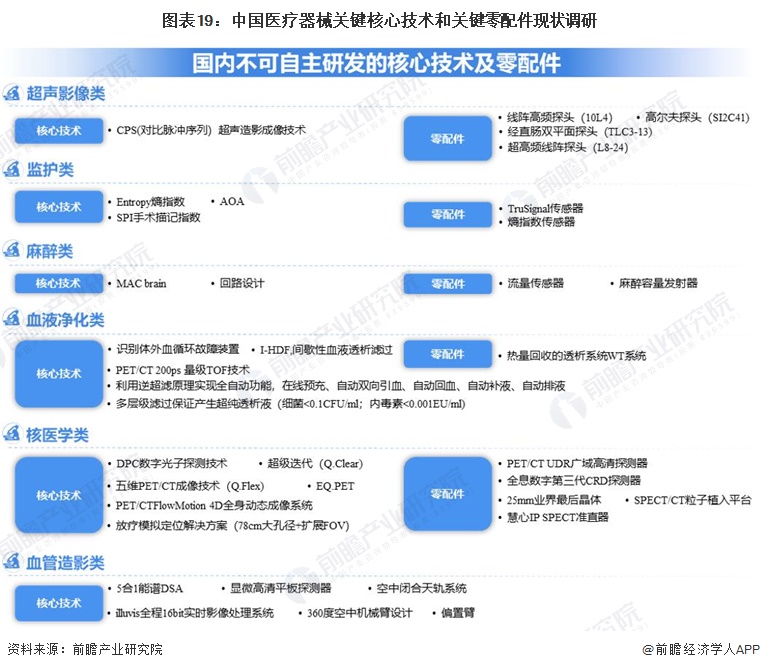

-- Core technologies for high-end medical devices still rely on imports

According to the State Drug Administration's key project "Research on the status quo of China's key core technologies and key parts of medical devices", the market retention rate of 11 product lines of ultrasonic imaging, monitoring, testing equipment, oral equipment, anesthesia, endoscopy, blood purification, angiography, radiotherapy equipment, nuclear medicine and rehabilitation was investigated by 1% enterprises. At present, there are still key technologies and key parts in ultrasonic imaging, monitoring, anesthesia, blood purification, nuclear medicine and angiography machine, and some technologies cannot be independently developed.

In October 2021, the Ministry of Industry and Information Technology published the "Recommended Catalogue of National Industrial Energy Saving Technologies (2021)", including energy saving and efficiency improvement technologies in the steel industry, non-ferrous metal industry, building materials industry, petrochemical and chemical industry, a total of 69 technologies in 8 categories.

Trend outlook

-- Development trend: multi-dimensional development trend

The high-end medical device industry has gradually shown the development trend in the following four aspects:

-- Development prospects: The industry is relatively prosperous and is expected to maintain its growth trend

In 2022, the global high-end medical device market size is 573.9 billion US dollars, with a compound growth rate of 6.8% from 2016 to 2022, and the global high-end medical device market size is expected to reach 663.8 billion US dollars in 2023. As the global aging process continues to accelerate, people's attention to health continues to improve, high-end medical device market demand to maintain rapid expansion, 2030 is expected to exceed $1.8 trillion.

In 2022, China's high-end medical device market will reach 1.3 trillion yuan. In 2023, China's high-end medical device market is expected to reach 1.4 trillion yuan, and the future China's high-end medical device market will maintain rapid growth and is expected to reach 2.8 trillion yuan in 2030.

For more research and analysis of this industry, see the Prospective Industry Research Institute's "China High-end Medical Device Industry Development Prospect Forecast and Investment Strategic Planning Analysis Report".

|

Last:Reprint: Market segment analysis of China ophthalmic high-value consumables industry in 2024

Next:Appearance and function examination of surgical instruments |

Return |