[Dry goods] Surgical robot industry chain overview and regional heat map in 2024

Major listed companies in the industry: Tianzhihang (688277), Weigao Orthopedics (688161), Minimally invasive robot (02252.HK), Kunbo Medical (02216.HK), etc

The core data of this paper: regional distribution heat map; Distribution number of industrial parks related to surgical robots; Surgical robot representative company's latest investment

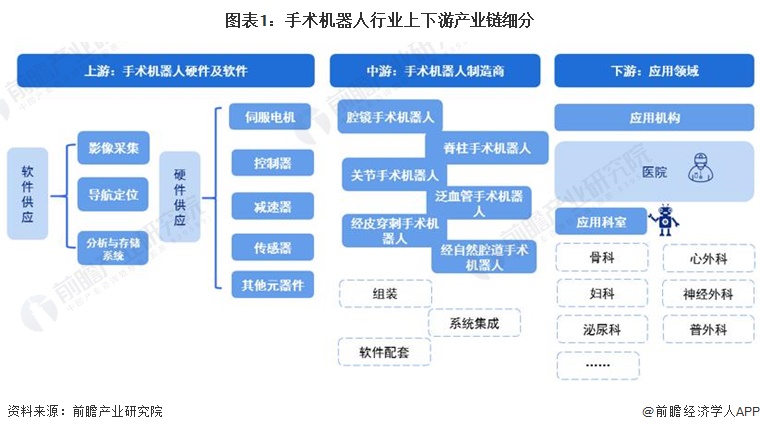

Surgical robot industrial chain overview: the industrial chain is gradually mature

The upstream raw materials of the surgical robot industry can be divided into software supply and hardware supply. The software supply includes image acquisition, navigation and positioning, analysis and storage system; Hardware supply includes servo motors, controllers, retarders, sensors, and other components. The middle reaches of the surgical robot manufacturing, including assembly, system integration, software matching. Downstream for application institutions, mainly for hospitals, application departments including orthopedics, heart surgery, gynecology, urology, neurosurgery, general surgery and so on.

At present, the upstream raw material suppliers of China's surgical robot industry represent enterprises with image acquisition suppliers such as ECko Optoelectronics; Reducer production company Hamanak, Japan Nabotsk, etc.; Servo motor representative company Siemens, MAXSON, Panasonic, etc.; The controller represents the company Huichuan Technology, Guangzhou numerical control, Huazhong numerical control, etc.

The middle reaches of the surgical robot manufacturing industry representative enterprises include Tianzhihang, Weigao, Minimally invasive robot, Kunbo Medical, Jingfeng Medical, BaihuiWeikang, Zhurui Technology, Connorsten, Huaruibo, Weimei Medical and so on.

The downstream demand for surgical robots is mainly hospitals. Specifically including orthopedics, heart surgery, gynecology, neurosurgery, urology, general surgery and other departments.

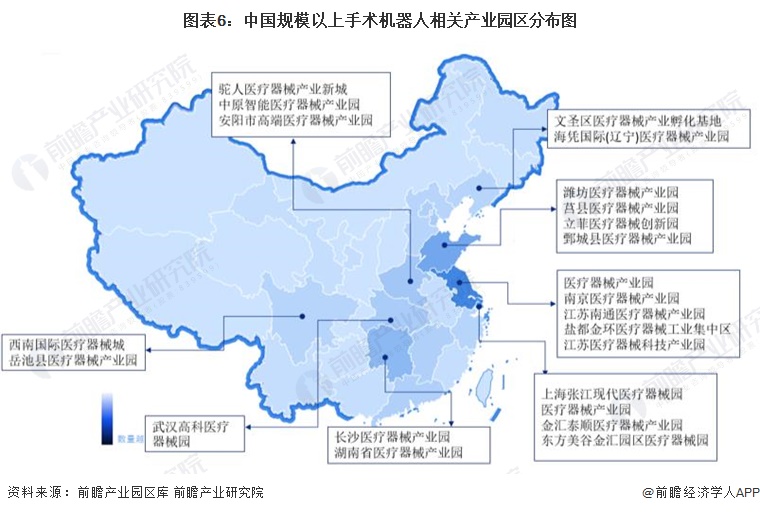

Regional heat map of surgical robot industry chain: Surgical robot industry focuses on developed provinces and cities

From the perspective of regional distribution of surgical robot industry chain enterprises in China, surgical robot industry chain enterprises are mainly distributed in developed provinces and cities, mainly in Guangdong; Jiangsu, Beijing followed, other places such as Sichuan, Zhejiang and other provinces also have some enterprise distribution.

In terms of the distribution of representative enterprises, there are more representative enterprises in Beijing and Guangdong. Surgical robot upstream supplier servo motor representative enterprises Siemens, surgical robot manufacturing representative enterprises Tianzhihang, BaihuiWeikang, Zhurui technology, and Huarebo, Weimei Medical, etc., gathered in Beijing. At the same time, Shanghai and Zhejiang also have more representative enterprises, such as Kunbo Medical, minimally invasive robot and so on.

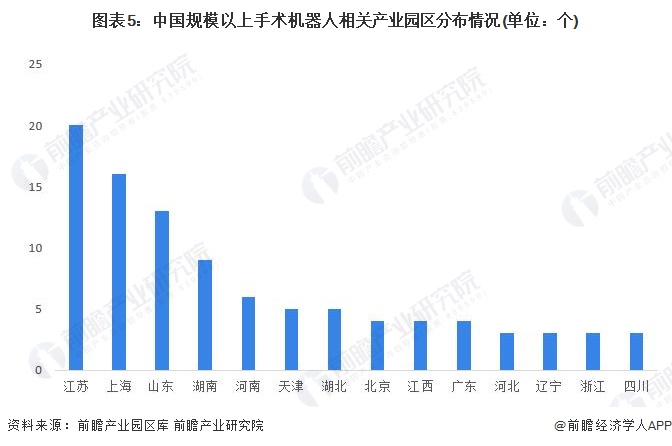

Distribution map of surgical robot related industrial parks: Jiangsu has the most

At present, there are fewer industrial parks set up for surgical robots in China, which are generally used to create a batch of production bases in combination with other medical devices and equipment using synergies between industries. There are 108 medical device industrial parks above scale in China, mainly distributed in Jiangsu, Shanghai and other places, of which there are 20 in Jiangsu.

Business layout of representative enterprises in surgical robot industry

From the perspective of the business layout of listed enterprises in China's surgical robot industry, the overall surgical robot enterprises in China have not yet had mature profitability, and the overseas market has not yet opened. At present, most of the representative companies of surgical robots in China are accelerating the commercialization process of R & D products.

Surgical robot industry representative company latest investment trends

The investment trends of the representative enterprises in the surgical robot industry mainly include the establishment of investment companies to expand business, and the expansion of business by means of capital increase of subsidiaries. The latest investment trends of representative companies in the surgical robot industry are as follows:

For more research and analysis in this industry, please refer to the "In-depth Research and Investment Strategic Planning Analysis Report of China Surgical Robot Industry" by the Prospective Industry Research Institute.

|

Last:Reprint: Market segment analysis of China ophthalmic high-value consumables industry in 2024

Next:Appearance and function examination of surgical instruments |

Return |