Core data of this paper: minimally invasive surgical instrument industry chain, stapler market size, endoscope market size

Industry profile

1. Definition

Minimally Invasive Surgery MIS, Minimal Access Surgery MAS (Minimally Invasive Surgery MIS, Minimal Access Surgery MAS) delivers special devices, physical energy or chemical agents into the body through minimal wounds or minimal approaches. The branch of medical science that performs surgical operations such as inactivation, excision, repair or reconstruction of lesions, deformities, and wounds in the human body to achieve therapeutic purposes, characterized by less trauma, faster recovery, and less pain than traditional surgery. Minimally invasive surgery mainly includes laparoscopic, thoracoscopic, hysteroscopic and arthroscopic surgery, and is widely used in five surgical specialties: general surgery, obstetrics and gynecology, urology, thoracic surgery and orthopedics. Minimally invasive surgical instruments are the main medical instruments used in minimally invasive surgical operations.

There are many ways to classify minimally invasive surgical instruments. According to functional classification, they can be roughly divided into endoscopic systems, supporting instruments, etc., among which supporting instruments mainly include puncture instruments, forceps instruments, scissors instruments, ligation instruments, suture instruments, and other related instruments.

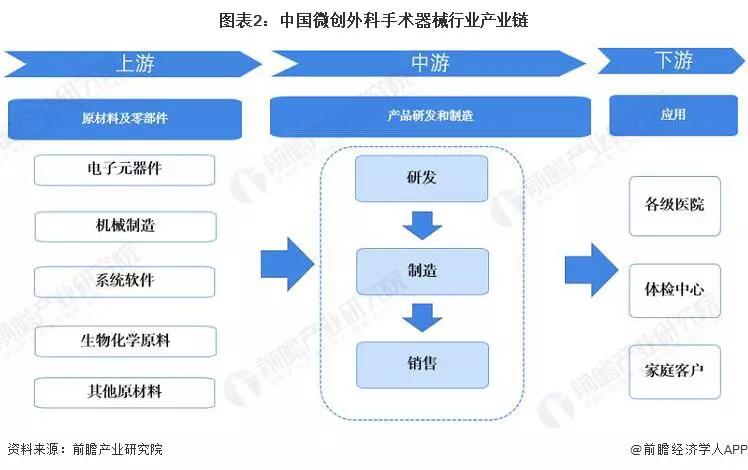

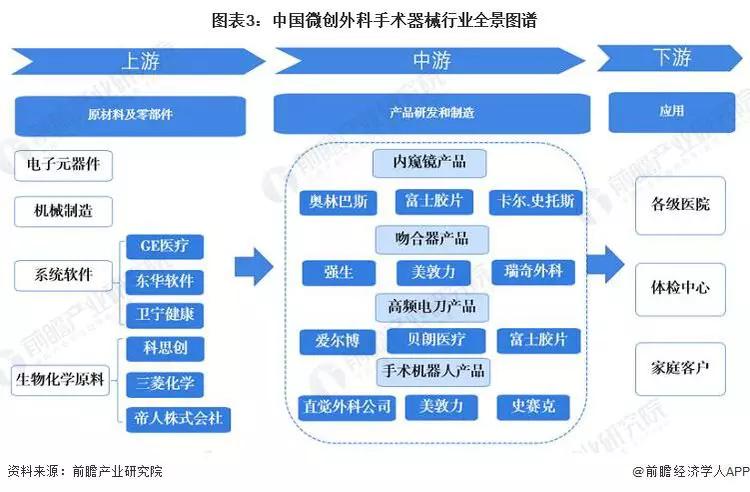

2. Industrial chain analysis: Midstream is the core link of the industrial chain

The upstream of minimally invasive surgical instrument industry mainly includes electronic manufacturing, mechanical manufacturing, system software, biochemical raw materials, other materials and other industries. The electronic industry provides electronic components, circuit boards, display screens and other parts for the medical device industry; the system software industry provides medical system data storage, analysis and other software; the biological industry mainly provides biological information detection technology for the medical device industry; the chemical industry provides testing reagents and other products for the medical device industry. Other materials industries mainly provide special material needs to meet the production and manufacturing of medical devices. The midstream industry is a minimally invasive surgical instrument research and development, production and sales of enterprises. The downstream industry is the medical and health industry, including hospitals, physical examination centers, etc.

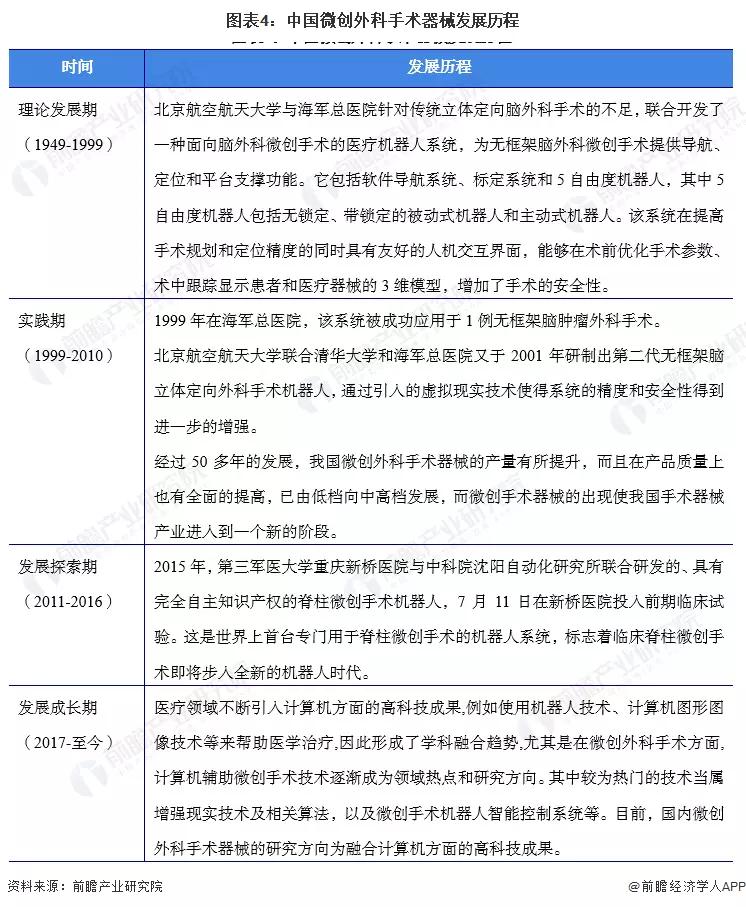

Industry development history: The industry has entered the stage of intelligent development

China's minimally invasive surgical instruments have been developed from scratch for more than 60 years, from the initial development of the theoretical system to the practical results of the initial development of the theory applied to practice, to around 2010, the development has entered a period of exploration, of which it is worth mentioning that in 2015, the independent innovation and development of minimally invasive surgical robots. This marks that China is gradually mastering the technology related to minimally invasive surgical instruments and gradually getting rid of the monopoly situation of foreign technology. Nowadays, China's minimally invasive surgical instruments have entered the stage of intelligent development, and the integration of minimally invasive surgical instruments and information technology is gradually becoming a research hotspot in the industry.

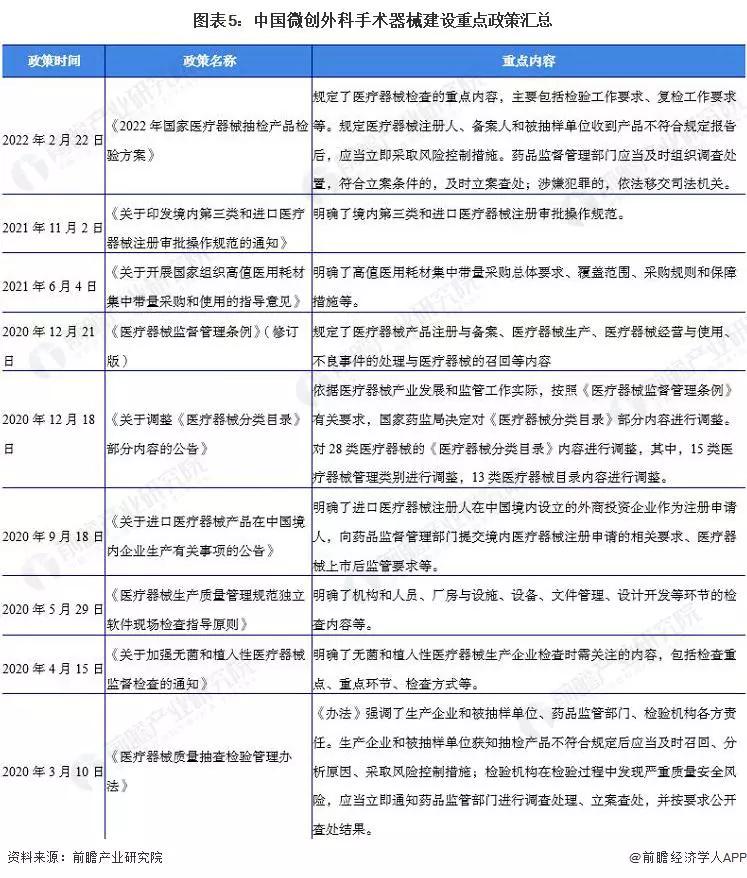

Industry policy background

In recent years, the state has introduced more policies related to the minimally invasive surgical instrument industry, including procurement policies and medical device management norms.

Industry development status

1. Analysis of stapler market in China

The staplers are mainly divided into intelligent staplers, open staplers and endoscopic staplers. According to Frost & Sullivan data, the market size of various staplers in China is on the rise, and the market size of intelligent staplers, endoscopic staplers and open staplers in 2021 in China will be 1.565 billion yuan, 4.992 billion yuan and 1.731 billion yuan, respectively, an increase of 58.4%, 14.0% and 13.43% compared with 2020.

2, China ultrasonic knife market analysis

From 2016 to 2021, the scale of China's ultrasonic knife market continued to grow. In 2020, the size of China's ultrasonic knife market exceeded 2 billion yuan for the first time, reaching 2.008 billion yuan, and the initial estimate in 2021 was 2.513 billion yuan, an increase of 25.15% from 2020.

3. Market analysis of minimally invasive surgical robots in China

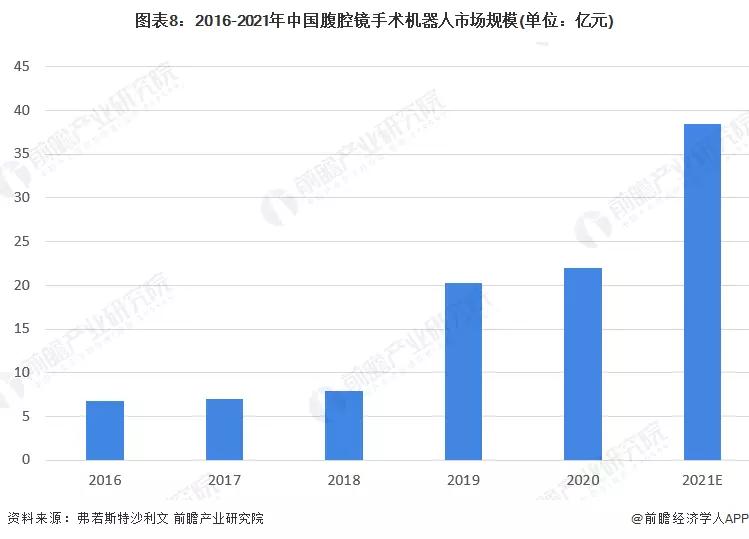

From 2016 to 2021, the market size of China's laparoscopic surgical robot has continued to grow, especially since 2019, the market size has exploded, reaching 2.197 billion yuan in 2020, and the preliminary estimate for 2021 is 3.851 billion yuan, an increase of more than 75% from 2020.

4. Analysis of China's endoscope market

2016-2021 China's medical endoscope market continued to grow, reaching 26.3 billion yuan in 2020, and a preliminary estimate of 28.4 billion yuan in 2021, an increase of about 7.98% from 2020.

5. Market analysis of minimally invasive surgical instruments in China

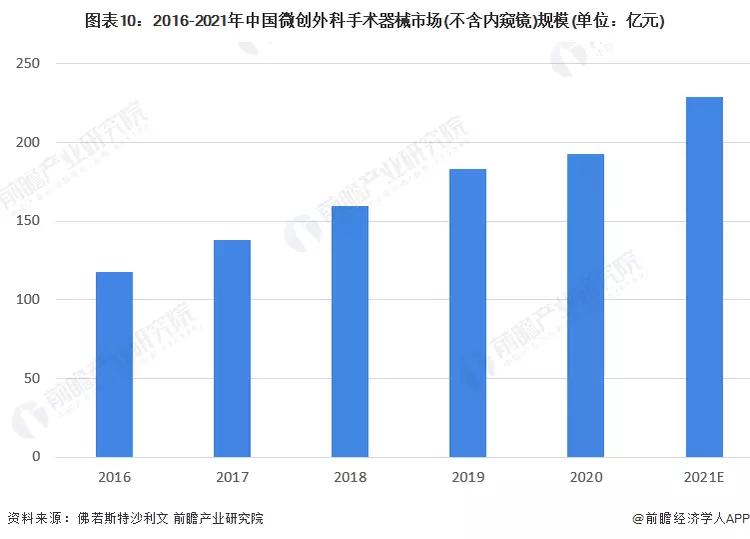

The scale of China's minimally invasive surgical instrument market (excluding endoscopes) continued to grow, from 11.772 billion yuan in 2016 to 22.893 billion yuan in 2021, with a compound annual growth rate of about 13%.

Downstream:

-- Number of medical institutions in China: Total growth in 2021

By the end of 2021, there will be 1.031 million medical and health institutions in China, including 37,000 hospitals. There were 977,000 community-level medical and health institutions, including 35,000 township hospitals, 36,000 community health service centers (stations), 307,000 out-patient departments (clinics) and 599,000 village clinics; There are 13,000 professional public health institutions, including 3,380 centers for Disease Control and Prevention and 2,790 health supervision centers. Compared with 2020, the number of hospitals increased by 0.1,600, grass-roots medical and health institutions increased by 0.7 thousand, and specialized public health institutions decreased by 0.15 thousand.

-- The number of medical institution visits in China: gradually recover in 2021

From the perspective of national diagnosis and treatment visits, there was a fluctuating trend from 2016 to 2021, and the number of diagnosis and treatment visits continued to rise before 2020, and there was a large decline in 2020 due to the impact of the epidemic. From 2021, the total number of diagnoses and treatment visits nationwide will reach 8.53 billion, an increase of 10.21% over 2020, and hospital diagnosis and treatment services will gradually recover.

-- The number of minimally invasive surgical procedures: increasing year by year

The number of minimally invasive surgical procedures and the penetration rate of minimally invasive surgical procedures in the Chinese population increased from 5.8 million units in 2015 to about 15.7 million units in 2021, respectively. As patient affordability increases, physicians' awareness and acceptance of minimally invasive surgery increases and the number of hospitals and physicians able to perform minimally invasive surgery increases.

Industry competition pattern

1. Regional competition: China's representative minimally invasive surgical enterprises are mainly located in coastal areas

China's representative minimally invasive surgical instrument enterprises are mainly distributed in coastal areas, such as Jiangsu, Shanghai, Zhejiang, Guangdong and other regions, including Kangji Medical, Mindray Medical, Yuyue Medical, Kelitai and so on. Other provinces and cities such as Beijing, there are also a number of minimally invasive surgical instrument manufacturers.

2, enterprise competition: Foreign brands still dominate

At present, the main participants in China's minimally invasive surgical instruments market are foreign enterprises, and domestic enterprises have a certain gap in product technology and quality compared with foreign enterprises. In recent years, after a long period of accumulation, domestic brands have successfully entered the market in individual segments. With the development of domestic product technology and the general trend of domestic substitution, local brands have gained more market share in the domestic market. In 2021, foreign enterprises in China's minimally invasive surgical instrument industry occupied 80%-85% of the market share, and domestic enterprises only accounted for 15%-20% of the market share.

Industry development prospect and trend forecast

1. Development trend analysis:

Minimally invasive surgery in the world and China is on the rise, the future minimally invasive surgery and even non-invasive surgery, with the help of more and more new medical devices, will achieve shorter surgery time, fewer complications, trauma or bleeding rate is lower, and is also expected to achieve the long-term hidden trouble removal more thorough, better healing goals.

In the future, the use of disposable products will increase. Compared with repetitive products, disposable products can reduce the risk of infection for patients and reduce the burden of sterilization for hospitals.

With the improvement of product technology and quality of domestic minimally invasive surgical instruments, domestic substitution will be accelerated, the competitiveness of domestic brands will also be improved, and the competitive pattern of China's minimally invasive surgical instruments market will be adjusted.

2. Market prospect forecast:

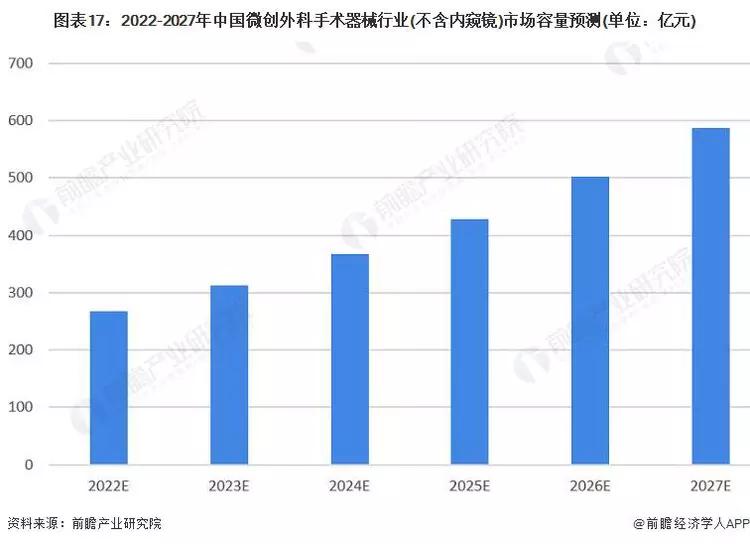

The market size of China's minimally invasive surgical instrument industry (excluding endoscopes) in 2022-2027 is expected to maintain an upward trend. Combined with historical trends and industry development potential analysis, by 2027, the market size of China's minimally invasive surgical instrument industry will reach 58.7 billion yuan, and the industry has great development potential.

The above data refer to the Prospective Industry Research Institute "China Minimally invasive surgical instrument industry market Foresight and Investment strategic Planning Analysis Report", At the same time, the Prospective Industry Research Institute also provides industrial big data, industrial research, industry chain consulting, industry map, industrial planning, park planning, industrial investment promotion, IPO fundraising research, IPO business and technology writing, IPO working paper consulting and other solutions.

|

Last:Reprint: Market segment analysis of China ophthalmic high-value consumables industry in 2024

Next:Appearance and function examination of surgical instruments |

Return |