01

Product analysis

| 1. The United States

(1) Management categories

According to JOINCHAIN statistics, the largest number of new medical device product registrations in the United States in the first half of 2024 is Class II devices, with the number of products being 1184, accounting for 73.18%.

Data source: MDCLOUD (Medical Device Data Cloud)

(2) Medical professional use

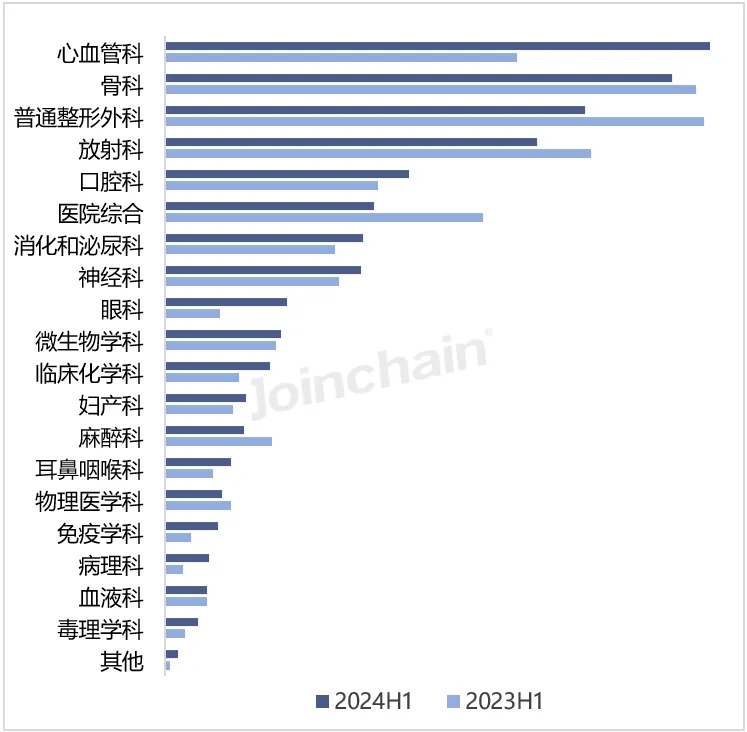

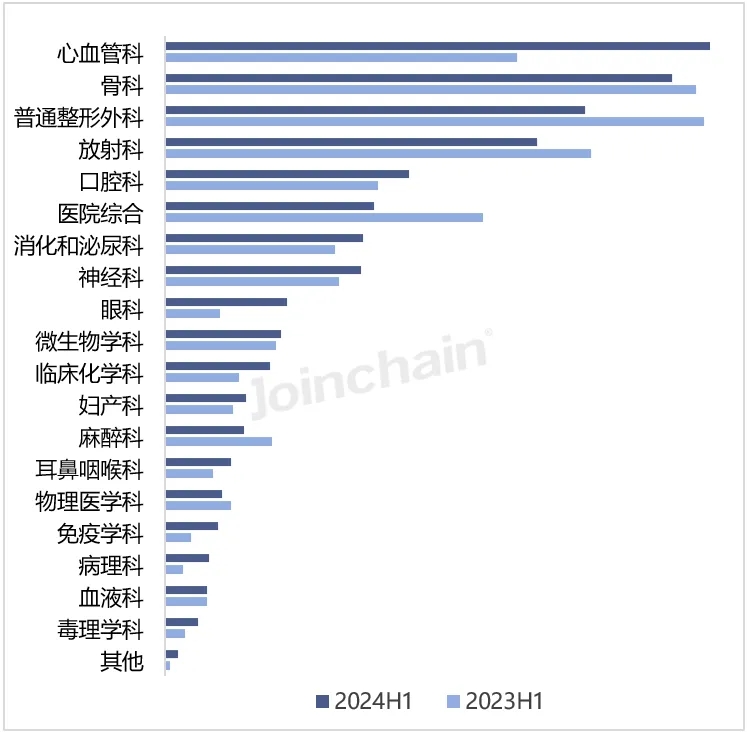

From the perspective of medical professional use classification, the number of newly registered products of cardiovascular devices in the first half of 2024 was the largest, with 264 products, accounting for 16.30%, an increase of 62.96%. Followed by orthopedic instruments, the number of products was 233, accounting for 14.38%, down 4.51% year-on-year. In addition, the growth rate of pathology, ophthalmology and immunology instruments was more obvious, with year-on-year growth rates of 150.00%, 124.00% and 100.00%, respectively. General plastic surgery, anesthesiology and hospital comprehensive equipment showed a downward trend, down more than 20%. The medical professional category with the largest number of approved products of Chinese enterprises is general plastic surgery 46, and the number of new products of hospital general and radiology instruments is close to 27 and 26, respectively.

FIG. 1 Distribution of newly registered products by medical specialty category in the United States in 2024H1

Data source: MDCLOUD (Medical Device Data Cloud)

FIG. 2 Medical professional categories of products approved for registration by Chinese enterprises in the United States in 2024H1

ata source: MDCLOUD (Medical Device Data Cloud)

(3) Medical professional use

From the perspective of product classification, the largest number of new medical device products registered in the United States in the first half of 2024 is "electric laser surgical instruments", the number of products is 37, involving 30 enterprises; Ranked second is "radiological imaging processing system", the number of products is 15, involving 15 enterprises; Ranked second is the "radiological imaging processing system", the number of products is 28, involving 25 enterprises. It is worth mentioning that in the top 20 product categories, Chinese enterprises have obtained product registration certificates, of which the number of Chinese enterprises' products of "polymer inspection gloves" and "porcelain powder" accounted for more than 50%.

Table 2 Classification of newly registered products in the United States in 2024H1 (Top20)

Data source: MDCLOUD (Medical Device Data Cloud)

From the perspective of the overall registration of Chinese enterprises, in the first half of 2024, among the medical device products approved by Chinese enterprises in the United States, the number of "electric laser surgical instruments" products is the largest, accounting for 29.73% of the total number of newly registered products in this category, involving 9 Chinese enterprises, accounting for 30.00% of the total number of registered enterprises in this category. Followed by "polymer inspection gloves", the number of products is 10, accounting for 58.82% of the total number of newly registered products in this category, involving 9 Chinese enterprises, accounting for 60.00% of the total number of registered enterprises in this category. Among the top 20 products, six products such as "photonic hair remover (over-the-counter)" are from Chinese companies.

Data source: MDCLOUD (Medical Device Data Cloud)

| 2. Australia

(1) Management categories

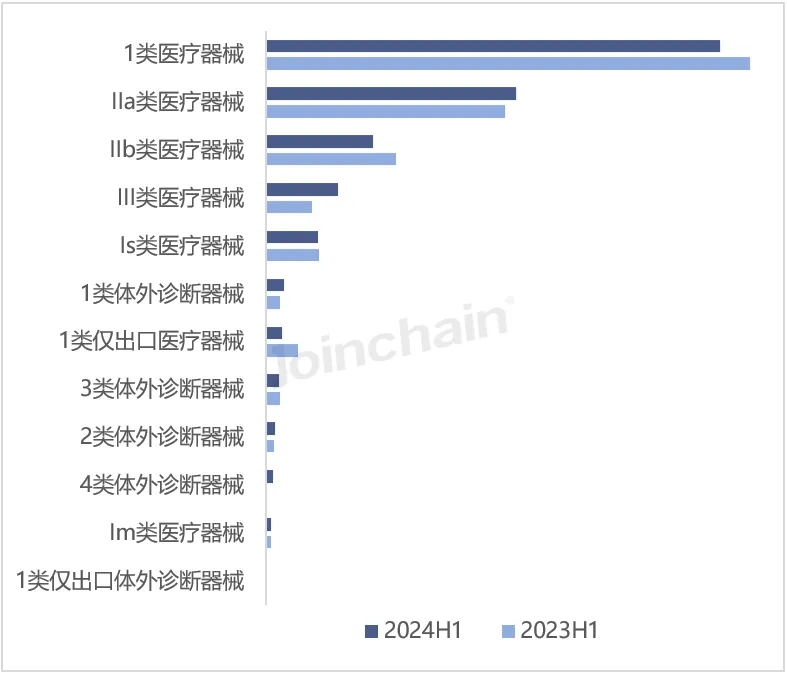

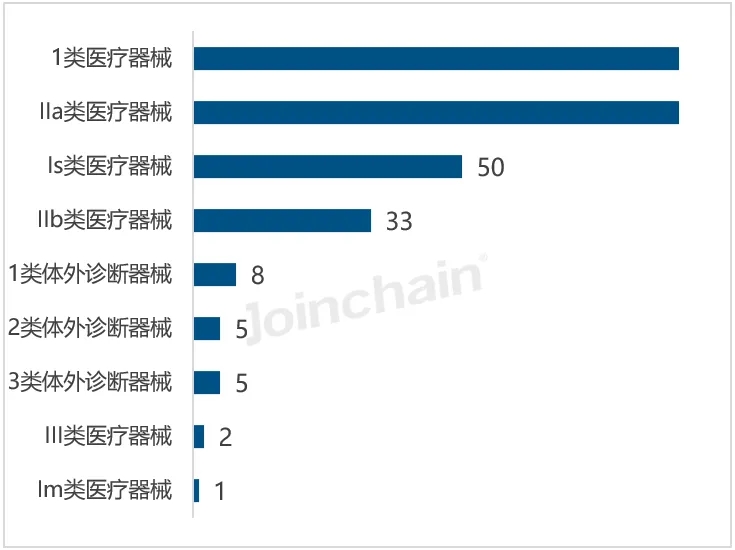

According to JOINCHAIN statistics, in the first half of 2024, the largest number of new medical device products registered in Australia is Class 1 medical devices, with 919 products, accounting for 45.20%, down 6.22% year on year; Followed by 505 types of IIa medical devices, accounting for 24.84%, an increase of 4.34%. In addition, 4 types of in vitro diagnostic devices, Class III medical devices and class 1 in vitro diagnostic devices grew faster, with year-on-year growth rates of 600%, 58.06% and 24.14%, respectively. The decline of category 1 only medical devices and IIb medical devices was more obvious, down 50.00% and 17.49%, respectively. The most approved products of Chinese enterprises are Class 1 medical devices 200, followed by Class IIa medical devices 123.

Figure 3 Distribution of newly registered product risk management categories in Australia in 2024H1

Data source: MDCLOUD (Medical Device Data Cloud)

Figure 4. The approved product management categories of 2024H1 Chinese enterprises in Australia

Data source: MDCLOUD (Medical Device Data Cloud)

(2) Product classification

From the perspective of product classification, the largest number of new medical device products registered in Australia in the first half of 2024 is "in vitro diagnostic instruments/analyzers", the number of products is 13, involving 13 enterprises; Ranked second is the "cochlear implant system coil", the number of products is 12, involving 1 company. It is worth mentioning that among the top 20 product categories, 19 products have Chinese domestic enterprises to obtain product registration certificates, of which "portable arm/wrist automatic inflation electronic blood pressure monitor" and "disposable isolation clothing" are all from Chinese domestic enterprises.

Table 4 Classification of newly registered products in Australia in 2024H1 (Top20)

Data source: MDCLOUD (Medical Device Data Cloud)

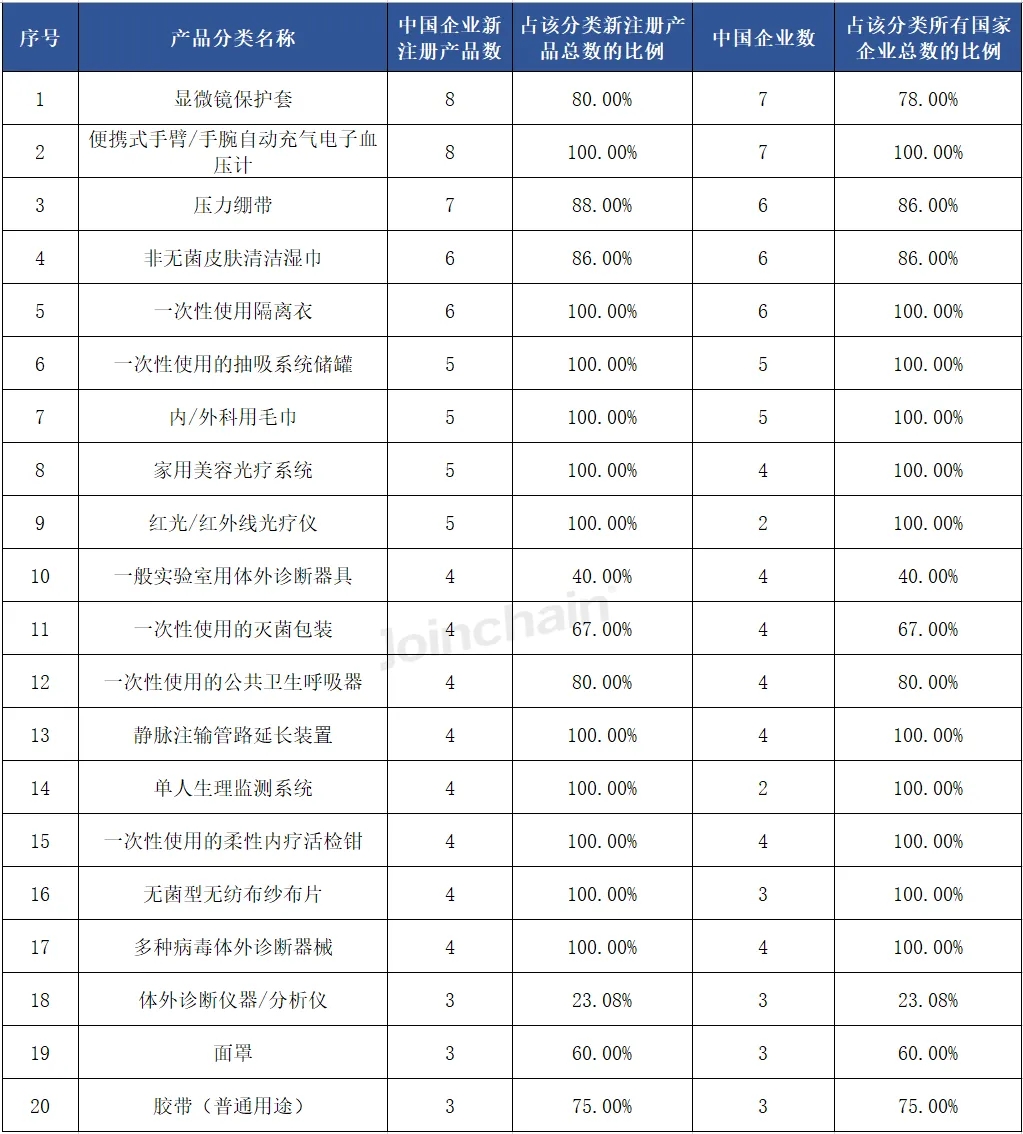

From the perspective of the overall registration of Chinese enterprises, in the first half of 2024, among the medical device products approved by Chinese enterprises in Australia, the number of products of "microscope protective cover" is the largest, accounting for 80% of the total number of newly registered products in this category, and 7 Chinese enterprises are involved, accounting for 78% of the total number of registered enterprises in this category.

Table 5 Classification of approved products registered by Chinese enterprises in Australia in 2024H1 (Top20)

Data source: MDCLOUD (Medical Device Data Cloud)

|

Last:Reprint: Large model companies, led by OpenAI, are fully exploring the medical market.

Next:Reprint: Reproduced: Prospective net needle is expected to be replaced? |

Return |