On July 29, 2024, the General Office of the National Health Commission issued a letter on informing the assessment of the medical service capacity of county hospitals in 2023 (hereinafter referred to as the "Letter").

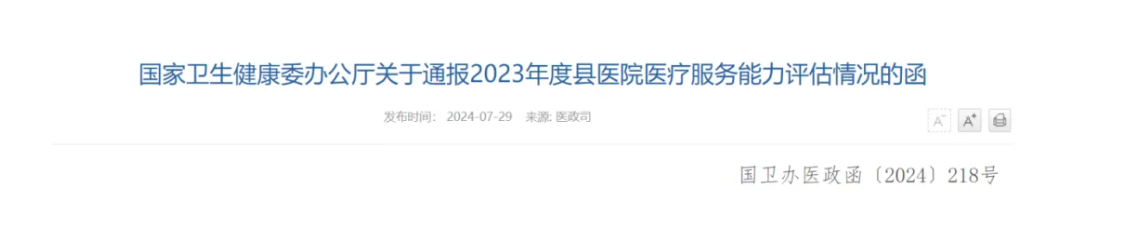

The letter pointed out that of the 2062 county hospitals participating in the 2023 assessment, 1894 (91.85%) meet the basic standards, of which 1163 (56.40%) meet the recommended standards, an increase of 38 and 199 compared with 2022.

Data source: National Health Commission

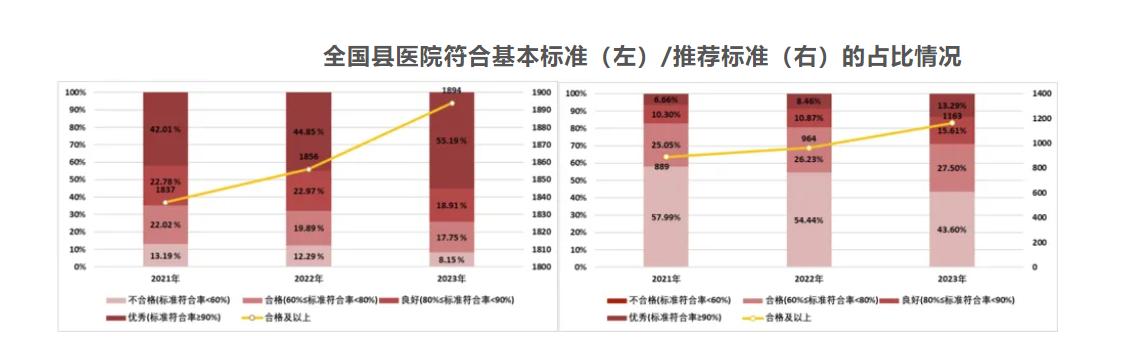

However, the "letter" emphasized that there are still 286 county hospitals have not yet configured blood dialysis machines. At the same time, according to the published service capacity of each department of the county hospital, the proportion of hospitals meeting the basic standards is 90.30%, and the proportion of hospitals meeting the recommended standards is only 61.15%, and the county hospital hemodialysis machine market still has a potential market blue ocean.

Source: National Health Commission

01

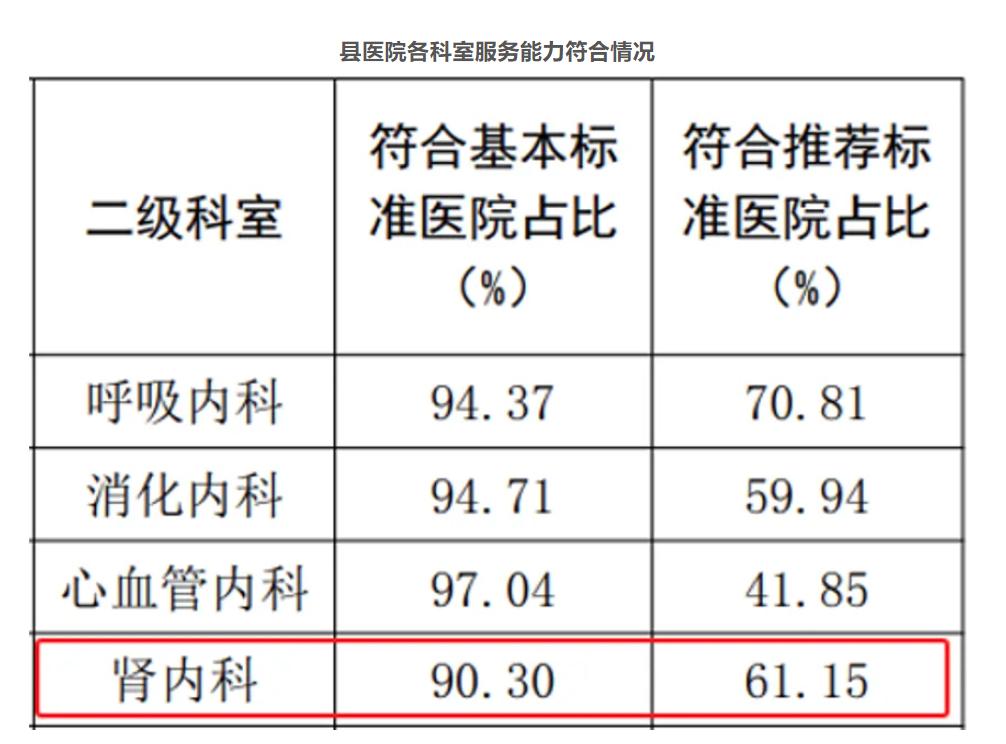

The number of registered hemodialysis equipment products increased steadily

Domestic production accounted for 60%

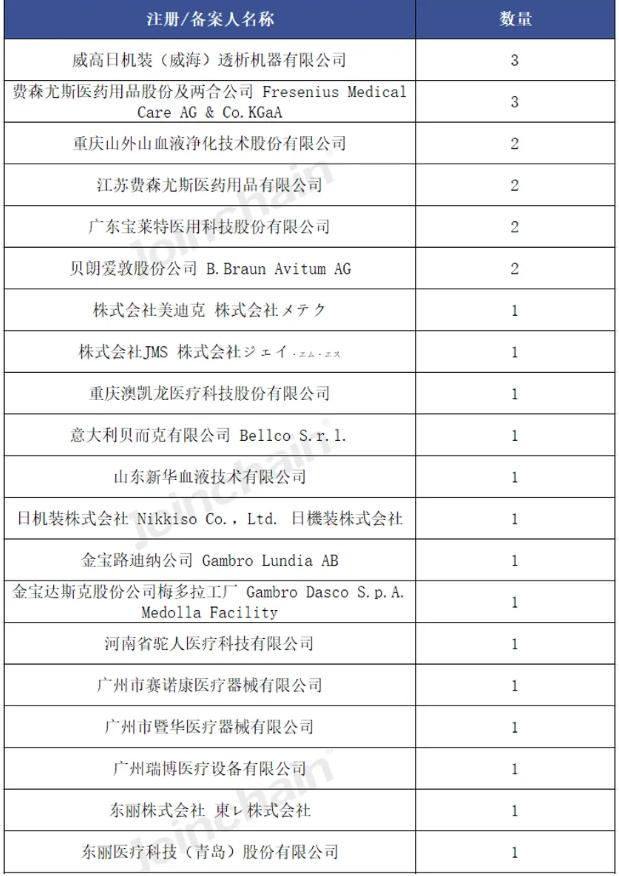

In recent years, the cumulative registered number of hemodialysis equipment products in China has steadily increased. According to statistics, as of June 2024, there are 30 effective products registered for hemodialysis equipment in China, of which 18 are domestic products, 12 are imported products, and the number of domestic products accounts for 60%.

Data source: Public Data Division

From the perspective of the number of product registrants approved, the number of registrations of domestic brand Weigao and imported brand Fresenius are higher than other enterprises.

Effective registrants of hemodialysis equipment products in China

02

County hospital hemodialysis equipment market is broad

Domestic brands are on the rise

In recent years, the domestic production rate of hemodialysis equipment in China has been continuously improved, and external dependence has been gradually reduced to achieve import substitution. As an important cornerstone of the medical system, county-level hospitals bear the task of dialysis treatment for a large number of grassroots patients.

According to the calculation of Zhongcheng Data Department, the market size of hemodialysis equipment in county-level hospitals in China increased from 591 million yuan in 2019 to 1.012 billion yuan in 2023, with a compound annual growth rate of 14.42%, and the market size is expected to reach 1.158 billion yuan in 2024.

2019-2024E Market size of hemodialysis equipment in county-level hospitals in China

Data source: Public Data Division

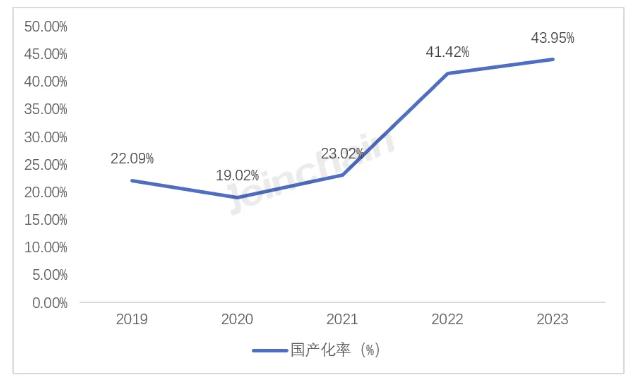

Under the influence of the policy of priority procurement of domestic equipment and technological breakthroughs of domestic brands, the localization rate of hemodialysis equipment rapidly increased from 22.09% in 2019 to 43.95% in 2023, an increase of 21.86%.

The localization rate of hemodialysis equipment in county-level hospitals in China in 2019-2023

Data source: Public Data Division

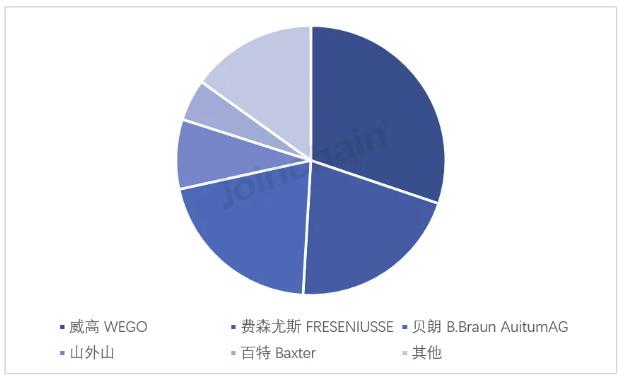

From the perspective of market competition pattern, market concentration has further improved in the first half of 2024, with TOP5 brands occupying 84.9% of the market share, an increase of 1.41% compared with the same period last year. Among them, Shandong Weigao successfully surpassed Fresenius with a market share of 30.20%, ranking first in market share.

2024H1 Market competition pattern of hemodialysis equipment in county-level hospitals

Data source: Public Data Division

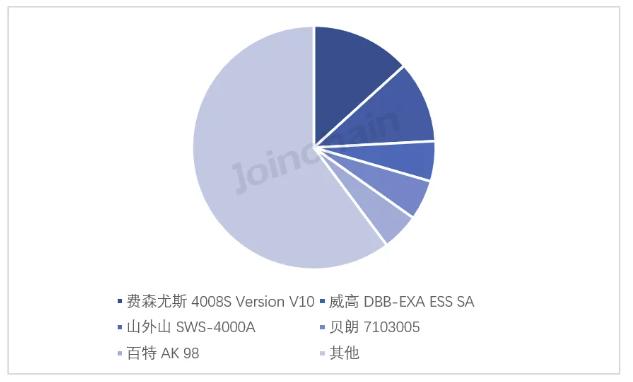

From the perspective of brand models favored by the county hospital market, Fresenius' 4008S Version V10 ranked first with 13.82% market share. At the same time, DBB-EXA ESS SA, a subsidiary of Shandong Weigao, rose to the second place with a market share of 10.87%, an increase of 10.50% compared with the same period last year.

2024H1 Market competition pattern of various types of hemodialysis equipment in county-level hospitals

Data source: Public Data Division

03

There are more than 10,000 hemodialysis equipment gaps in county-level hospitals

The potential market exceeds 1.7 billion yuan

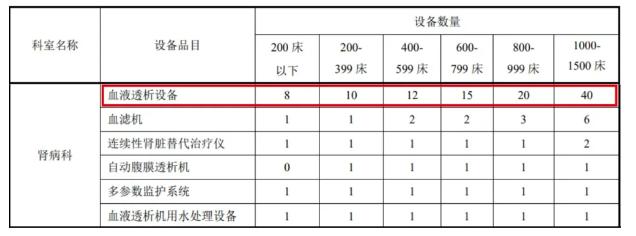

According to the provisions of the "WS/T 819-2023 County General Hospital Equipment Configuration Standard" issued by the National Health Commission on July 26, 2023, on the provision of hemodialysis equipment for county hospitals, hospitals of different sizes need to be equipped with a corresponding number of hemodialysis equipment.

Minimum equipment configuration standard for county-level general hospitals

Data source: WS/T 819-2023 Equipment configuration standard for county-level general hospitals

The minimum configuration requirements of hemodialysis equipment in county general hospitals are 8 sets! The proportion of nephrology department in county-level hospital that meets the recommended standard is only 60%! According to the reasonable calculation of the Department of Public Data, there is still a market gap of about 11441 hemodialysis equipment in the county hospital market, and the potential market size is as high as 1.752 billion yuan.

At the same time, with the support of national policies such as large-scale equipment replacement and county medical capacity building, the equipment configuration of county-level hospitals in the renal department will be further strengthened according to national standards, and the potential market size will be rapidly expanded in the next few years, and the market size of hemodialysis equipment in county-level hospitals is expected to reach 2.91 billion yuan by 2028.

2019-2028E Market size of hemodialysis equipment in county hospitals

Data collection: Mass Data Section

In the future, with the increasing number of patients with chronic kidney disease and end-stage renal disease in China, the dialysis treatment rate of end-stage renal disease patients will continue to increase, and the number of dialysis patients will continue to increase. At the same time, with the extension of dialysis age of hemodialysis patients, the hemodialysis industry has a broad room for growth.